Vodafone Sells €1.3 Billion Stake in Vantage Towers to Reduce Debt

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

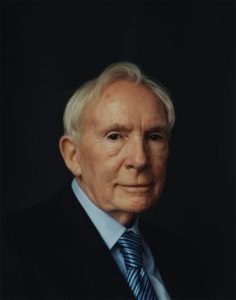

From starting a career as a clerk to becoming the chairman of a multinational company is not a piece of cake. The recipient of the Mountbatten Medal and the most successful businessman of UK, Sir Ernest Harrison, was the first chairman of Vodafone, who started his journey as the head clerk at the parent company of Vodafone. His decision making and business skills led him and his company at the top of the telecom business.

Early Life

Sir Ernest Harrison was born in Hackney, north-east London, on 11 May 1926. His father was a docker, working under the Casual Labour Scheme, and his mother was a dressmaker, in an East End garment factory. He moved to Holloway with his family and attended Trinity Grammar School, Wood Green. During his school, he became a die-hard fan of the Arsenal Football Club and played in his school football team. He got his education interrupted when the world war 2 broke out, and he was evacuated. In 1944, joined the Fleet Air Arm, in Canada.

Career

During his service at the Fleet Air Arm, he received a training in accountancy. In 1951, after his release, he joined the newly formed Racal Telecom, as the chief accountant, and the 13th employee, at a monthly salary of £650. Soon, he became the chief buyer, following by the role of personnel director, and contract negotiator, of the company. He held many important positions while working in Racal, in his 50-year career with Racal. He was appointed the deputy managing director in 1961 and eventually, became the chairman of the company, in 1966.

With Harrison, Racal won many crucial deals, like negotiation of a British Army battlefield radio contract, a merger between Racal and British Communications Corporation, acquiring Decca, and buying the British Rail Telecommunications network, etc.

Creation of Vodafone

In July 1982, Harrison, as the chairman of Racal, along with Jan Stenbeck, from the Millicom, Inc., jointly bid for the UK’s second cellular radio licence, forming a company, named Racal-Millicom, Ltd. In the bid, the company won the second UK mobile phone network license. With the final ownership of Racal-Millicom, Ltd, Racal holding 80% and Millicom holding 15% shares, on 1 January 1985, Racal-Millicom launched Racal-Vodafone Ltd. in Newbury, Berkshire. In December 1986, by paying a total sum of GB£110 million, to the smaller shareholders, Racal Electronics transformed Vodafone into a fully owned brand of Racal Telecom.

By the end of 1996, Vodafone had acquired the major shares of many other telecom companies, like Talkland, Peoples Phone, Astec Communications, etc. In September 1991, Racal Telecom demerged into Vodafone. It expanded to other neighbouring countries and after 2005, it established its network in other continents too.

Vodafone became the first telecom company to provide roaming call. Currently, Vodafone serves 400 million customers all over the world.

Personal Life

Harrison’s first marriage was with Beryl Cole and had twin sons with her. The two got divorced in 1959. Harrison, in 1960, got married to Janie Knight, with whom he had three children. He loved watching Arsenal football matches and also, enjoyed horse races. He had a hobby of collecting medals. Harrison died on 16 February 2009, at the age of 82.

Yashica is a Software Engineer turned Content Writer, who loves to write on social causes and expertise in writing technical stuff. She loves to watch movies and explore new places. She believes that you need to live once before you die. So experimenting with her life and career choices, she is trying to live her life to the fullest.