Elon Musk’s Controversial Drug Habits Are a Growing Concern for Tesla’s Board

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

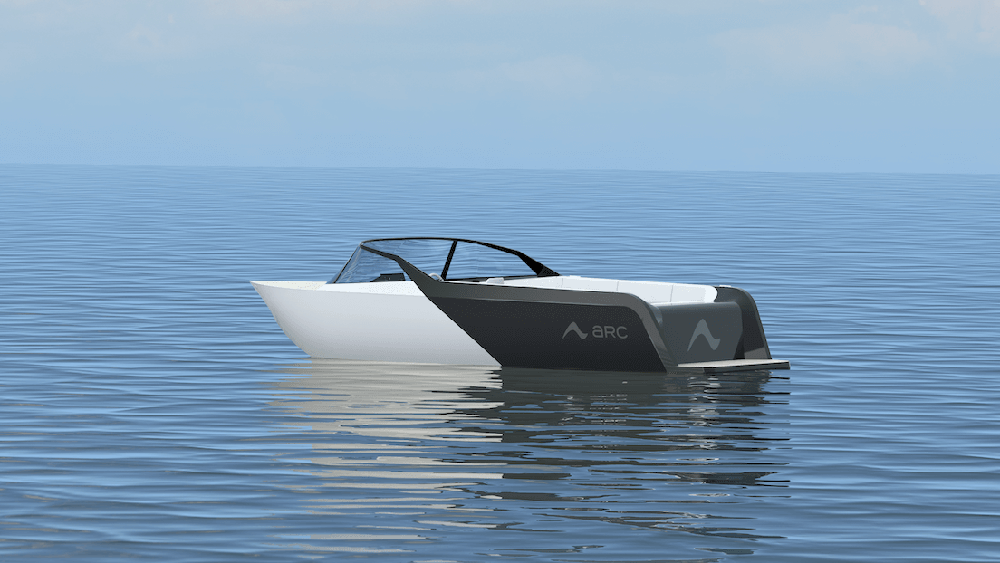

Every year, about 12 million recreational boats travel through America’s streams, spewing foul emissions, gasoline sheens, and screaming noises from engines in their wake. Several firms are already working to expand the electric vehicle trend that is currently sweeping across streets globally into rivers, lakes, and coastal seas.

One of the more recent entries in the expanding marketplace for battery-operated boats is Arc Boat Company. The Los Angeles-based business, whose group comprises former engineers from Tesla and SpaceX, was founded in 2021 with the goal of electrifying the sector, beginning with the creation of an expensive luxury powerboat.

The business announced on Wednesday that a seventy-million-dollar Series B investment round had been completed, increasing its total capital to over 100 million dollars. The current venture capital investors in Arc, including Menlo Ventures, Lowercarbon Capital, Andreessen Horowitz, and Abstract Ventures, participated in the round.

“Gas boats are noisy, they’re noxious, they are super-unreliable,” Mitch Lee, Arc’s CEO and co-founder, told Canary Media. “Electric boats solve a lot of those pain points. But the hard part is execution of the technology.”

news.yahoo.com

Arc intends to use its new investment to develop and produce wakeboarding speed boats from a new facility in Torrance, in the state of California, to appeal to a larger, though still somewhat wealthy, marketplace of recreational boaters. Within the span of 18 months, the firm hopes to double its employment to about 140, according to Lee.

Also Read: Cellnex Agrees to Sell Nordics Stake for €730 Million

Just one percent of the nation’s yearly carbon dioxide emissions from gasoline-powered vehicles come from recreational boat engines. They have an even more immediate negative effect on the ecosystem because they release airborne pollutants that cause smog and leak gasoline. Recreational boats can nevertheless be excellent initial prospects for creating the zero-emissions technology required to clean up bigger, long-distance boats, according to transportation professionals, even if they have far fewer energy requirements than, for example, a high-powered fishing boat or a cargo ship.

“It’s really hard to package enough power into a boat to be directly competitive with existing gas options,” Lee said. “It’s a testament to our team that we’ve delivered these [Arc One] boats on an incredibly fast timeline” while working toward the next phase of the company’s journey, he added.

news.yahoo.com

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

In a shocking revelation, Tesla Inc. has fallen victim to a recent data breach that has affected more than 75,000 individuals. The breach has been attributed to “insider wrongdoing,” as disclosed in an official notice from the Maine Attorney General’s office. The breach has brought employee-related records to the forefront, impacting both present and former Tesla employees.

This alarming breach came to the surface thanks to the vigilance of a foreign media outlet, Handelsblatt, which notified Tesla on May 10, 2023, about the acquisition of confidential data pertaining to the company. A comprehensive investigation was swiftly initiated, unveiling a disconcerting truth: two former employees had exploited their positions to improperly access and share sensitive information, flouting Tesla’s rigorous IT security and data protection protocols. This breach has once again underscored the potent threat of internal breaches that organizations face.

Tesla has responded with unwavering determination to address this breach. Legal actions have been promptly set into motion against the two former employees who stand accused of perpetrating this security breach. The judicial intervention has culminated in the confiscation of electronic devices, which are believed to house proprietary company data. Court-issued mandates have been secured to forestall any future misuse, unauthorized access, or distribution of this purloined data, invoking severe legal repercussions.

Throughout the investigative process, Tesla has demonstrated its resolute commitment to combating this breach. Collaborating closely with law enforcement agencies and external forensics experts, the company has navigated the complexities of this incident. Tesla’s unwavering cooperation underlines its dedication to unearthing the truth and seeking justice for the impacted individuals.

While the particulars of the lawsuits directed at the former employees remain confidential, the implications of this breach extend beyond legalities. Data breaches wield the potential to inflict substantial harm upon individuals and the organizations entangled in their wake. In an age dominated by digital interconnectedness, safeguarding sensitive information stands as a paramount responsibility. Companies, irrespective of their industry, must place data security atop their priority list and institute rigorous measures to avert unauthorized access and the misuse of confidential information.

Also Read: China Tech Giant Tencent’s Revenue Disappoints Amid Weak Game Sales

As Tesla grapples with the fallout from this incident, it serves as a stark reminder to all companies regarding the gravity of data breaches and the perils of internal vulnerabilities. The saga underscores the indispensability of nurturing a culture of data security within an organization, founded upon stringent protocols and constant vigilance. Through unwavering dedication to data protection, organizations can aspire to thwart not only external threats but also the insidious perils that lurk within their own ranks.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

As competitiveness heats up, Tesla Inc. has released two lesser specification models of its less widely popular Model S as well as Model X electric cars to the United States and Canadian market, cutting their cost by ten thousand dollars.

Compared to the base models, the more affordable variants have a little shorter range and slower acceleration. As per the automobile giant’s website, the ‘Standard Range’ Model S sedan has a price of 78,490 USD, whereas the less expensive Model X sport utility is priced at 88,490 USD.

Just under five per cent of Tesla’s shipments in the second half were of the Tesla Model S and X, which represent a small portion of the company’s revenues. The S and X do not receive any price reductions, which lessens the appeal of them. In contrast to the 3 and Y, which are qualified for a 7,500 dollars US tax credit.

Elon Musk, the company’s chief executive officer, indicated in July that if interest rates kept rising, Tesla was going to keep cutting its pricing and that he was prepared to give up more profit to increase production and sales.

The cost of Tesla’s higher-spec Model Ys in China was reduced on Monday by 14,000 yuan which is approximately $1,900, raising fears of a fresh pricing war in the fiercely competitive Chinese market.

A competing attempt by Tesla to lower pricing once further in China’s mainland caused shares to fall up to as 3 per cent in early Monday trade.

Shares somewhat recovered from their initial losses to trade in the red, finishing Monday down about 1.2 per cent. The company made the announcements late on Sunday night in a Weibo post.

Sold at 299,000 & 349,000 yuan in China, two Model Y crossovers from Tesla have been marked down by 14,000 yuan, or almost two thousand dollars.

A limited-time insurance subsidy for the Model 3 will be available for 8,000 yuan, which is approximately 1,100 dollars. According to Tesla’s statement, the insurance subsidy will keep running through the end of September.

Also Read: ChatGPT Creator OpenAI Is Testing Content Moderation Systems

The second half of 2023 saw a fierce pricing battle between Tesla and indigenous Chinese automakers including BYD, Nio, as well as Xpeng that severely reduced Tesla’s profit margins. Even as it increases output in its Shanghai Gigafactory, Tesla has fallen behind domestic rivals.

Tesla reduced pricing numerous times in 2022 and 2023 to reduce inventory and increase delivery, the closest estimate of sales the firm provides.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person