What happens to the smaller VC firms in a conservative market?

In the dynamic world of venture capital (VC), market conditions play a significant role in shaping the fortunes of firms. When confronted with a conservative market, characterized by risk aversion and cautious investor sentiment, smaller VC firms face unique challenges. This blog explores the potential consequences and strategies available to navigate such circumstances.

In a conservative market, investors tend to gravitate towards safer, established companies with proven track records, often overlooking riskier early-stage startups.

This reduced appetite for risk impacts smaller VC firms, which primarily focus on early-stage investments. As a result, these firms may struggle to attract sufficient capital, making it challenging to deploy funds and support new ventures.

With limited investor interest, smaller VC firms may face difficulties in raising the necessary funds to sustain their operations. The conservative market environment often leads to decreased commitments from existing limited partners and makes it more challenging to attract new investors.

Consequently, smaller VC firms may experience a decline in their available capital, hindering their ability to participate in lucrative investment opportunities.

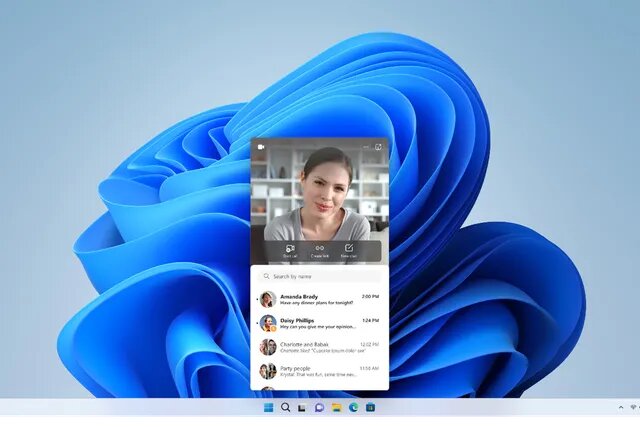

Also Read: Why is Microsoft Teams integration being removed from Win11?

Conservative markets tend to have a ripple effect on portfolio companies within the VC firm’s investment ecosystem. As startups face reduced funding options, they may encounter difficulties in securing subsequent financing rounds.

Smaller VC firms may be forced to allocate more resources to support existing portfolio companies rather than making new investments. Consequently, the overall growth and success of the portfolio may be limited, potentially affecting the firm’s reputation and ability to attract future investments.

To adapt to a conservative market, smaller VC firms may need to adjust their investment focus. They may shift towards industries or sectors that are more resilient in such conditions, such as healthcare or essential services.

Additionally, they might concentrate on later-stage investments or seek out more established startups that demonstrate stability and a clear path to profitability.

By adapting their investment strategy, smaller VC firms can increase their chances of generating returns even in a conservative market.

In a conservative market, smaller VC firms face significant challenges due to limited investor appetite, funding constraints, and portfolio company struggles.

However, by adapting their investment focus, exploring alternative funding sources, and providing extensive support to existing portfolio companies, these firms can navigate the conservative landscape and position themselves for success in the long run.

B. Pagles Minor, a first-time fund manager who established DVRGNT Ventures seven months ago, has encountered challenges in the fundraising landscape.

Contrary to expectations, limited partners are demanding more extensive metrics and data, resulting in unexpected expenses. Additionally, emerging managers like Minor are facing financial burdens as certain insurances, previously not commonly required, are now being requested.

Another emerging trend is limited partners seeking concessions such as waiving certain management fees or requesting lower carry in the fund. These circumstances further strain fund managers’ ability to establish and effectively run their funds.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.