SoftBank May Turn Profit After $48 Billion in Vision Fund Losses

After five quarters of revenue losses, SoftBank Group Corporation’s Vision Fund is set to earn a profit owing to a recovery driven by artificial intelligence which is increasing startup market valuations.

After suffering losses of 6.9 trillion dollars approximately $48 billion over the previous two years of operation at the Vision Fund investment subsidiary, the Japanese behemoth is battling to restore its foundation.

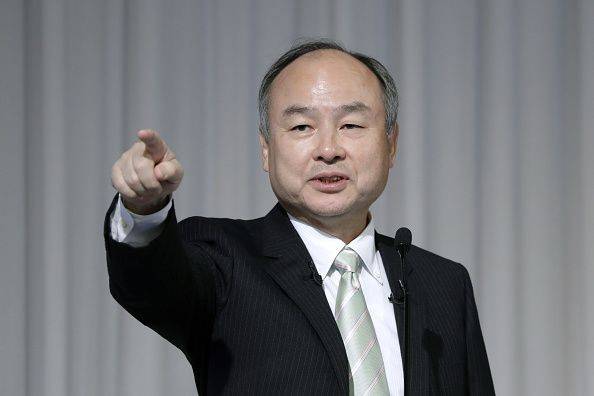

Based on the average of expert expectations, analysts anticipate a minor gain at the investment company for the three months ending in June, whereas SoftBank is expected to disclose a profit of about 73 billion dollars on Tuesday.The IPO (Initial Public Offering) of Arm Ltd. will determine if SoftBank owner Masayoshi Son can embark on the attack and look for new possibilities in business.

In a marketplace launch as early as September, his chip creator hopes to make a profit of a maximum of ten billion dollars at an estimated valuation of 60 to 70 billion dollars. If Arm were successful in achieving its fundraising goal, it would surpass Meta Platforms Inc. as well as Alibaba Group Holding Limited as the biggest technology debut ever.

The values of Arm’s competitors have increased as a result of their obsession with artificial intelligence. The valuation of NVIDIA Corporation has surpassed a trillion dollars this year, and the Nasdaq 100, a barometer for technology firms, had its greatest January-June result ever.

Also Read: Crypto stocks dip after bitcoin slumps to six-week low.

According to Kirk Boodry, a researcher at Astris Advisory, SoftBank provides investors with a means to participate in Arm as an artificial intelligence play before its debut.

“A further run once a public prospectus comes out would not be surprising at all,” he said.

“I’m not convinced we are completely out of the woods yet,” as July’s gains may turn out to be ephemeral while “tech seems priced for perfection (again),” Boodry said. Still, the bounce is “worth highlighting,” and Arm’s upside should provide support even if the Vision Fund looks weak, he said.

Source: finance.yahoo.com

According to Boodry’s estimation, the Vision Fund’s public holdings increased by around 1.1 billion dollars in the June quarter. The two companies that contributed the most, DoorDash Inc. along with Grab Holdings Ltd., had increases of 20 per cent and 14 per cent, respectively, throughout the time frame. Coupang Inc. had a 9 per cent increase. In the same time frame, SoftBank’s stocks increased 31 per cent, which was a three-year high.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person