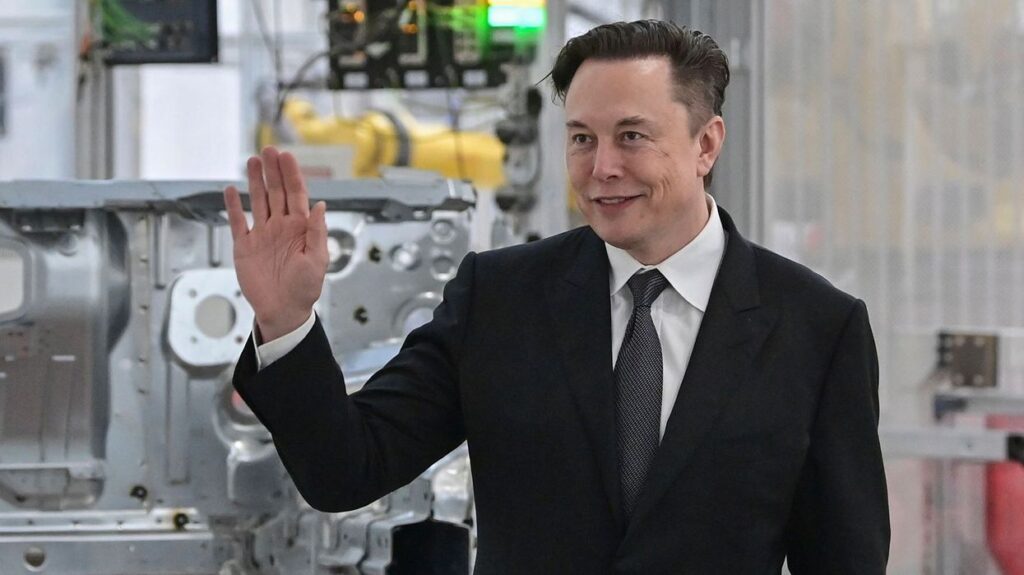

Elon Musk Makes ‘Best And Final’ Offer To Buy Twitter; Launches Hostile Takeover Bid Worth $43 Billion.

Elon Musk, a billionaire entrepreneur, has offered to buy Twitter Inc. for $43 billion, slamming the company’s management and claiming to be the only person who can unlock the “extraordinary potential” of a communication platform used by more than 200 million people every day.

Musk said he’ll pay $54.20 per share in cash, which is 38% higher than the price on April 1, the last trading day before he went public with his stake. In New York on Thursday, the social media company’s stock was little changed at $45.81, indicating scepticism that one of the platform’s most outspoken users will succeed in his takeover attempt.

“I invested in Twitter because I believe it has the potential to be a global platform for free speech, and I believe that free speech is a societal imperative for a functioning democracy,” he wrote in the filing. “However, since making my investment, I’ve come to realise that the company, in its current form, will neither thrive nor serve this societal imperative.”

Elon Musk, 50, made the offer public on Thursday in a filing with the US Securities and Exchange Commission. On April 4, the billionaire, who also owns Tesla, revealed a 9 percent stake in the company. Tesla’s stock dropped 1.5 percent in pre-market trading as a result of the news.

Twitter’s board of directors will consider the proposal, and any response will be in the best interests of “all Twitter stockholders,” according to the company.

The bid is the latest chapter in Musk’s tumultuous relationship with the social media platform. The executive is one of Twitter’s most-followed firebrands, frequently tweeting memes and taunts to his more than 80 million followers as @elonmusk. He’s been vocal about the changes he’d like to see at the social media platform, and the company offered him a seat on the board after he announced his stake, which made him the company’s largest individual shareholder.

Elon Musk began soliciting feedback from fellow Twitter users soon after his stake was made public, proposing everything from turning Twitter’s San Francisco headquarters into a homeless shelter to adding an edit button to tweets and granting automatic verification marks to premium users. Given that several celebrities with large followings rarely tweet, one tweet suggested that Twitter might be dying.

He is one of the few people who can afford a full takeover because he is dissatisfied with the power that comes with being Twitter’s largest investor. According to the Bloomberg Billionaire’s Index, he’s worth around $260 billion, compared to Twitter’s market value of around $37 billion.

In a letter to Twitter’s board, Musk stated that “in its current form, Twitter will neither thrive nor serve [its free speech] societal imperative.” Twitter should be turned into a private company.”

It is unlikely that the takeover will take a long time. “If the deal doesn’t work, I’ll have to reconsider my position as a shareholder,” Musk said. “I don’t have faith in management and don’t believe I can drive the necessary change in the public market.”

According to today’s statement, Musk informed Twitter’s board of directors over the weekend that he believes the company should be taken private.

According to Vital Knowledge’s Adam Crisafulli, the $54.20 per share offer is “too low” for shareholders and the board to accept, despite the fact that the company’s shares hit $70 (roughly Rs. 5,300) less than a year ago.

Despite the fact that Musk is the world’s richest man, he has yet to reveal how he will come up with $43 billion in cash.

“This becomes a hostile takeover offer that will cost a significant amount of money,” said Neil Campling, Mirabaud Equity Research’s head of TMT research. “To fund it, he’ll have to sell a significant amount of Tesla stock or take out a large loan against it.”

What is Musk’s goal for Twitter?

Musk is one of the most popular people on Twitter, with 80.5 million followers, outnumbering celebrities like Kim Kardashian and Selena Gomez.

However, his frequent tweeting has resulted in regulatory issues, such as his long-running dispute with the Securities and Exchange Commission after he tweeted in 2019 that he had the funds to buy Tesla for $420 per share. That didn’t happen, but it did cause the stock to rise, drawing the attention of regulators.

Musk had been expected, as Twitter’s largest shareholder, to press the company on issues of free speech, a subject on which he has spoken out. Musk’s acquisition offer letter emphasised this point, emphasising his commitment to “free speech.”