South Korea’s Nand Flash Memory Chip Exports Return to Growth

Nand flash memory shipments from South Korea increased for the very first time in the past twelve months, adding to the indications that the decline in semiconductor demand had peaked.

In contrast to an 8.9 percent decline in August, shipments rose 5.6 percent from a year prior in September, the commerce ministry reported in a statement on Monday. Dynamic random access memory exports (DRAM), another segment of the memory-chip industry, fell by 24.6 percent in the same time frame, a less dramatic decrease than the 35.2 percent drop seen a month prior.

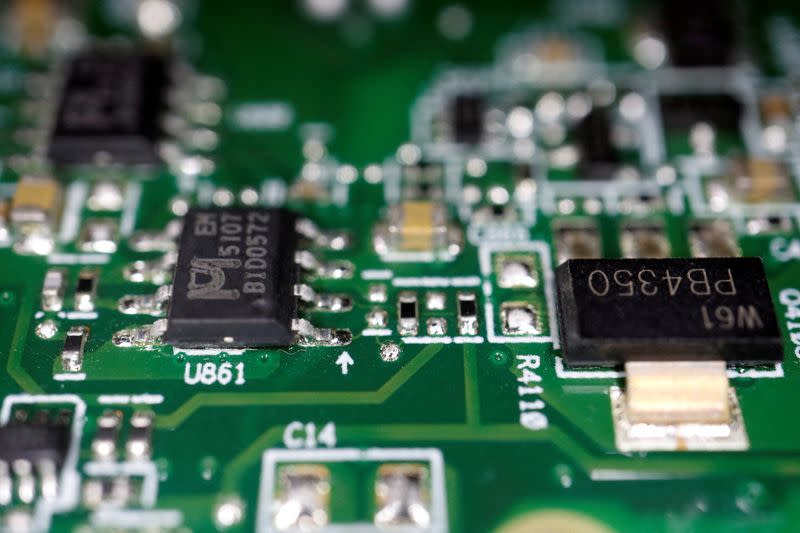

Memory chips are a key component of Korean exports, which are highly dependent on the demand for technological products on a worldwide scale. Nand is less profitable than DRAM, but it is a preferred material among manufacturers of memory cards, digital cameras, as well as other gadgets that are portable due to its capacity to store data even in the absence of electricity.

In an effort to support economic development in an era when worldwide interest rates are anticipated to rise for longer and impact total spending, Korean officials are banking on a rebound in chip demand.

The majority of the worldwide memory market is controlled by Samsung Electronics Co. along with SK Hynix Inc., while Japanese wafer and equipment producers hope to benefit from a rebound in semiconductor sales. The electronics sector of Samsung is primarily recognized for its well-liked smartphones and televisions. Due to shortages, the corporation has increased its reliance on providing semiconductors to manufacturers worldwide in the past few years.

According to data from the Commerce Ministry, total semiconductor shipments to China continued to struggle in September, down 22.7 percent from a year before. While shipments to the US fell by 30 percent, those to the European Union (EU) increased by 56.5 percent.

With an estimated 230-billion-dollar investment by memory chip juggernaut Samsung Electronics, South Korea claims it will construct a sizable facility to manufacture memory chips in the bigger Seoul area.

President Yoon Suk Yeol revealed the intentions on Wednesday, and the electronics behemoth later confirmed them.

Also Read: TCS Seeks to Use Microsoft AI Partnership to Improve Margins

“We will build the world’s largest new ‘high-tech system semiconductor cluster’ in the Seoul Metropolitan area based on large-scale private investment of almost 300 trillion Korean won,” he said.

“In addition, we will grow the ‘semiconductor mega cluster’ to the world’s largest in connection with the existing memory semiconductor manufacturing complexes.”

edition.cnn.com

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person