Apple Plans to End Credit Card Partnership with Goldman Sachs

In a surprising move, tech giant Apple (AAPL) has reportedly informed Goldman Sachs (GS) of its intention to dissolve their consumer credit card partnership within the coming 12 to 15 months. This decision could have implications for cardholders and potentially reshape the landscape of Apple’s financial services strategy.

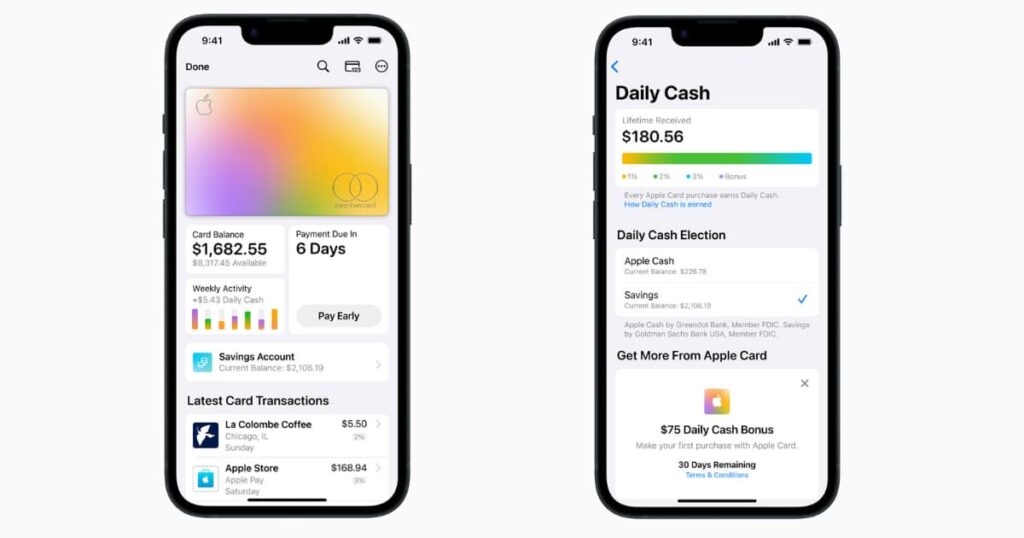

The collaboration between Apple and Goldman Sachs led to the creation of the Apple Card and savings accounts. Despite being a part of Apple’s services revenue, Tech Editor Dan Howley from Yahoo Finance points out that these financial offerings might not be pivotal in Apple’s revenue stream. Howley suggests that while these services might not significantly bolster earnings, they serve a different purpose – creating a “lock-in” effect.

Lock-In Strategy: Anchoring Users to the Apple Ecosystem

The concept of ‘lock-in’ revolves around linking a user’s credit card and savings account to their Apple devices. Howley explains that this strategy aims to enhance customer loyalty by making it inconvenient to switch to competitor products. With the integration of financial services into the Apple ecosystem, users are less likely to shift to rival platforms, ensuring a long-term commitment to Apple’s products and services.

Image Source: pymnts.com

Speculations arise regarding Apple’s potential collaboration with different banks to continue their foray into financial services. While Apple maintains its brand presence in these services, the banking infrastructure is supported by partners like Goldman Sachs. Any transition to a new financial institution might involve reissuing cards, but the core strategy of ‘locking in’ users is expected to persist.

Apple's Dual Role: Innovator in Tech, Cautious in Finance

Apple’s dominant position in technological innovation contrasts with its cautious approach to highly regulated financial services. Howley underscores that Apple’s separation from the banking infrastructure allows it to maintain a positive sentiment among consumers, steering clear of potential apprehensions associated with being deeply involved in finance.

Amidst reports of dissolving the partnership, concerns arise regarding the continuity of user-centric features. The unique attributes of the Apple Card, including its color-coded spending indicators and flexible payment options, have garnered praise. Howley points out the importance for Apple to preserve these aspects while potentially switching banking partners, ensuring a seamless transition without compromising user experience.

Apple’s move to unwind its partnership with Goldman Sachs signifies a strategic shift in its financial services landscape. While the decision might not heavily impact revenue, it solidifies Apple’s intent to maintain a strong grip on its user base by integrating financial services within its ecosystem. As the tech giant navigates this transition, preserving user-centricity will be crucial in retaining customer trust and loyalty.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.