The ongoing COVID-19 pandemic has, in many ways, spelled good news for entertainment services. Around the world, we have seen streaming services, and gaming companies witness a spike in usage as people remain confined to their homes. In keeping with this fashion, Disney+ recently released a statement that they had over 60.5 million active subscribers as of yesterday. Here’s a quick look at how the company’s journey has been, and what this means for other streaming services.

Picking

Up Subscribers

As per

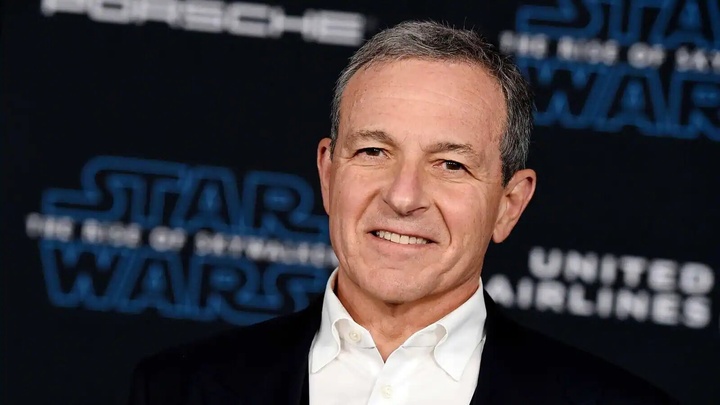

a statement by Bob Chapek, who serves as the CEO of The Walt Disney Company,

Disney+ has over 60.6 million subscribers as of August 4th. The news came out

while discussing or going over the financial report of the company over the

last quarter. The financial report covered the company’s earnings over a

period, ending on June 27th. Since the report did not include subscriber

increase in July, it reported the count as 57.5 million users. However, Chapek

was quick to point out that the streaming service was doing much better than

ever imagined. He also stated that Disney+ was enjoying a growth rate that

initial projections did not predict.

Early

Beginnings

Disney’s

streaming service launched in November 2019. In April of this year, the company

passed the 50-million subscriber milestone. However, this included subscribers

of Hotstar India and free subscribers as a part of the Verizon promotional

campaign. The company first tested its streaming service in the Netherlands,

before launching in both the US and Canada in November. As a part of their

launch, the company’s catalogue included The Mandalorian, and deep archives

consisting of Marvel, Disney and Pixar movies and shows. Furthermore, the channel

also contained 30 seasons of the hit American show- The Simpsons. The service

was made available on iOS, Android, the web, smart TVs, Roku and even through

game consoles.

Journey till Now

Disney+ wasn’t the company’s first experience with streaming, having tried the same with ESPN+. Also, following its acquisition of Fox, Disney has taken over Hulu, while also owning Hotstar. A big selling point for the service was the fact that it would have exclusive rights to Marvel movies after they left the theatre. During their first year, the company spent over $1 billion in generating original content, while planning to increase this $2.5 billion by 2024. Also, the service is a delight for parents as it is family-friendly, having no R-rated content on it.

Push from COVID

The COVID pandemic has helped accelerate the growth of such streaming services greatly. For instance, Netflix was able to add over 10 million subscribers to its already large user base. It now boasts of over 193 million active subscribers. Similarly, ESPN+ too has been growing exponentially, reaching a gross of 8.5 million users as of June this year. Hulu, which is another service owned by Disney grew by 27% to over 35.5 million subscribers, out of which 3.4 million pay for both live television and video on demand. Disney+ has benefitted from the release of Hamilton, which came out during the 4th of July weekend. Chapek also announced that Disney+ would release Mulan on September 4th. However, the premiere access will only be available for people who do not mind paying an additional $29.99.

Fall

in Revenue

Disney’s revenue from its international and

Direct-To-Consumer divisions grew by 2% to eclipse $4 billion. However, the

company’s operating loss also grew to $706 million from the earlier $562

million. Netflix too felt the impact of the pandemic, showing a 10% drop in

share value for their second-quarter. Revenue for the quarter inched close to $6.15

billion, while the operating income ran up to $1.36 billion. Hence, the

company’s net income was $720 million, per-share earnings being $1.59. However,

investors were looking for per-share earnings of $1.81.

Yet, the growth of Disney+ will serve as

encouragement for Disney, which is suffering due to the COVID-19. Most of their

other businesses, including their theme parks, have had to face severe

restrictions due to the ongoing pandemic. Disney’s overall revenue fell by 42%

as a result to $11.8 billion, with earnings per share showing a loss of $2.61.

However, with the Disney+ service looking up, the parent company has much to celebrate. A lot of new titles are up on the line for the company, and subscription is expected to keep growing till the end of this year. It will also be interesting to see how the company adapts to this surge in users and comes out with new original content this year.

Being a cinephile with a love for all things outdoorsy, Athulya never misses a chance to chase inspiring stories or poke fun at things, even when the subject is herself. Currently pursuing a degree in mechanical engineering, she is someone innately interested in technical and scientific research. Music reviews and op-eds define her as they allow her to explore different perspectives. Though sometimes she thinks she makes more sense playing the guitar than she does while writing.