Samsung’s Profit Slide Slows in Sign of a Chip Market Bottom

After stopping losses at its chip division, Samsung Electronics Co. recorded a more gradual decline in quarterly profit, raising the possibility that the worldwide semiconductor sector had turned into a downward spiral.

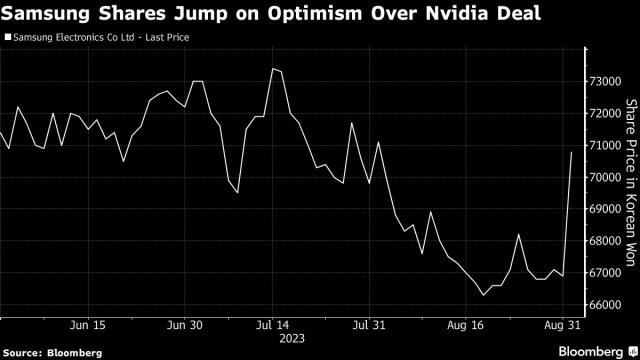

A 78-cent reduction in operating profits was better than expected, according to some investors, and this helped Samsung’s shares rise as high as 4.4%, which is the biggest in more than a month. The biggest corporation in South Korea, along with its smaller competitors SK Hynix Inc. along with Micron Technology Inc., has been experiencing an industry slowdown. In response to sluggish demand for gadgets and an oversupply of chip inventory, dependable clients, such as manufacturers of personal computers and mobile phones, have reduced their purchases.

As per Samsung’s initial figures, operating income decreased to roughly 2.4 trillion won which is approximately $1.8 billion despite a decline of 13 percent in earnings in the three months leading up to September. The figures are better than the record 95 percent year-on-year decline in the previous quarter, which is in line with analyst predictions.

Expectations are rising that Samsung’s semiconductor business “has pretty much passed the bottom,” said Sanjeev Rana, head of Korea Research at CLSA. “And the recovery is underway in the fourth quarter.”

finance.yahoo.com

Samsung now aims to take advantage of the long-expected rise in AI-related technology expenditure, which is being driven by enthusiasm among investors and customers for OpenAI’s ChatGPT launch last autumn.

However, Samsung is lagging behind tiny Hynix, the primary provider of next-generation DRAM to artificial intelligence chip manufacturer Nvidia Corp., in building the tools required to train artificial intelligence models. By 2024, Samsung claims it will have doubled its production capacity for high-bandwidth memory, which has the capability required to accelerate AI training

Samsung is a leader in the memory market, which quickly increased production to satisfy demand brought on by the epidemic. The business continued to spend throughout the recession, burdening itself and its major clients with excessive inventory.

“The result was better than expected,” said Lee Seung-Woo, an analyst at Eugene Investment & Securities. “The bottom for the memory chip industry is behind us and Samsung’s results showed that.”

finance.yahoo.com

Also Read: BlackRock Invests in German Fintech Firm Targeting New Investors

However, Samsung and Hynix have stated they will withstand financial turmoil by reducing the manufacture of NAND chips used in personal computers and smartphones until AI-related demand turns into revenue.

Before trading on Wednesday, shares of Hynix had increased by more than 60 percent compared to Samsung’s rise of 20 percent earlier this year.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person