Tencent Leads $80 Billion Rout as China Rekindles Crackdown Fear

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

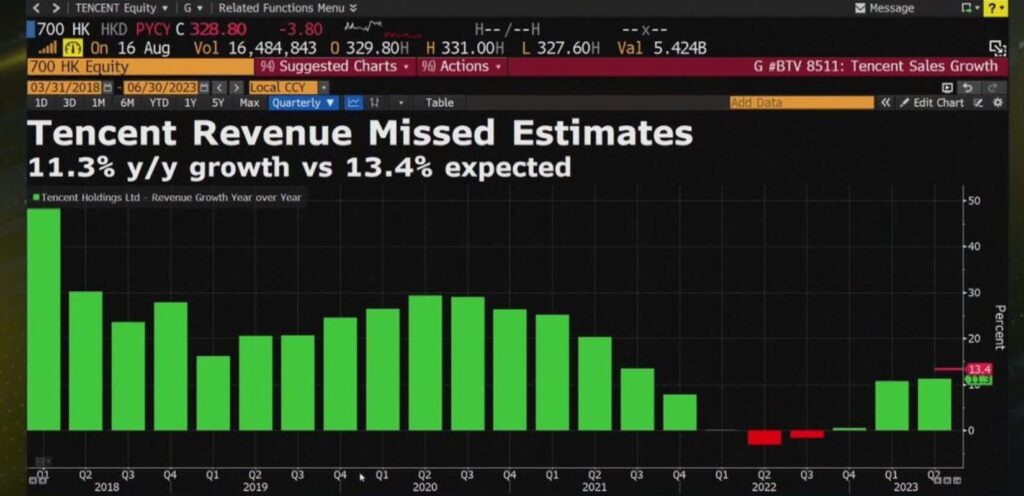

As a struggling economy hampered Tencent Holdings’ recuperation from the year’s record-breaking fall, revenue growth was lower than anticipated in the second quarter. Tencent Holdings is a Chinese social networking and gaming behemoth.

The expansion of Tencent’s primary gaming division was less robust than anticipated in the January through June period. With fluctuations in currencies removed, domestic gaming income remained stable at 31.8 billion yuan whereas overseas revenue from gaming increased 12 per cent to 12.7 billion yuan.

James Mitchell, the business’s chief strategy officer, explained why the business decided to momentarily launch less socially impacting material in its second fiscal quarter as the cause of the video game industry’s poor growth during a conference call with investors.

The owner of the WeChat texting network and the biggest video gaming firm in the world, according to industry observers, is now facing intense rivalry from its rivals. According to an analyst at Blue Lotus Capital Advisors, Shawn Yang, although Tencent’s fresh releases are up against fierce competition from other game developers like NetEase Inc. as well as miHoYo, its older blockbuster titles have provided subpar revenues owing to a lack of material.

In the three months ending June 30, profit increased 11 per cent to 149.20 billion yuan which is approx $20.45 billion, falling short of the 151.73 billion yuan mean forecast of 21 analysts surveyed by Refinitiv. Little altered from the 10.7 per cent increase in the first quarter, the rise in revenue was stable.

Due to Beijing’s regulatory repression on the internet industry, Tencent reported its very first sales fall during the same period last year, which resulted in a decrease of one per cent in revenue.

Also Read: X to Get Rid of Ability to Block Accounts, Owner Elon Musk Says

For China’s internet behemoths, like Tencent, regulatory anxiety has decreased this year as a result of Chinese officials’ desire to increase private sector trust. However, the world’s second-biggest economy has not grown since late last year, when COVID-19 limits were eased. In comparison to the same time in the previous year, net profit increased 41 per cent to 26.17 billion yuan. However, it was below the average expert expectation of 33.41 billion yuan.

One of the positive aspects was the income that came from web advertisements. As demand for its clip-sharing service similar to TikTok, Video Accounts expanded, jumped 34 per cent to 25 billion yuan. According to the firm, growth in both offline as well as online payment operations was the reason for the fifteen per cent rise in earnings from financial technology and business offerings to 48.6 billion yuan.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

According to Tencent, Apple has recently launched an online store on the popular Chinese app WeChat.

The store has been integrated into WeChat’s mini-programs, which are small applications within the platform that offer various services such as e-commerce, finance, and transportation.

Apple’s store on WeChat will feature a range of its products, including iPhones, iPads, Apple Watches, and Macs. This is not the first time Apple has established a presence on a Chinese platform, as it already operates a store on Alibaba’s Tmall e-commerce platform, which is a competitor of Tencent.

In addition to this, Apple also experimented with live commerce in China earlier this year, attempting to sell its products through interactive live streaming.

China is a significant market for Apple outside of the United States. According to research firm Counterpoint, the iPhone 13 series dominated the top three spots in the list of best-selling phones in China in 2022.

Despite a decline in China’s smartphone market in the first quarter of 2023, Apple has managed to maintain its position as the leading handset vendor in the country, capturing a 20% market share. This represents a 2% increase compared to the same period in the previous year, as highlighted in a report by Counterpoint.

However, Apple has been actively working to diversify its manufacturing operations by reducing its reliance on China. JP Morgan analysts reported last year that the company plans to shift 25% of its iPhone production to India and 20% of its iPad and Apple Watch production to Vietnam by 2025.

Also Read: Binance chief strategy officer Patrick Hillmann steps down

This strategic move aims to mitigate risks associated with overdependence on a single manufacturing location and take advantage of the benefits offered by other countries in terms of cost, logistics, and supply chain resilience.

In summary, Apple has expanded its presence in the Chinese market by launching an online store on WeChat, one of China’s most popular apps. This move follows Apple’s existing store on Alibaba’s Tmall platform and its previous foray into live commerce.

While China remains a crucial market for Apple, the company is actively working to diversify its manufacturing operations by gradually shifting production to countries like India and Vietnam. These efforts align with Apple’s strategy to reduce its dependence on a single manufacturing base and leverage the advantages offered by different regions.

The launch of Apple’s online store on WeChat demonstrates the company’s commitment to reaching Chinese consumers through diverse channels and platforms

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

A restriction by China on the distribution of Micron memory chips to important domestic corporations represented the most recent turning point in the Sino-American business spat, and a US-based micron technology corporation predicted a blow to earnings in the low-single to high-single-digit percent.

late on Sunday, China’s cyberspace watchdog announced that Micron, the largest US memory chip manufacturer, was unsuccessful in its network safety examination and would be prohibited from selling to controllers of critical assets.

It did not elaborate on the threats it had identified or the products of the business that would be impacted.

Experts noted that the majority of Micron’s major Chinese clients are firms in the customer electronics industry, and thus they foresaw little immediate effect on the company. However, they cautioned that political hazards may cause some businesses to remove Micron products from their supply networks.

Also Read: Australia hits buy-now-pay-later sector with consumer credit law

At a press conference, Mark Murphy, Chief Financial Officer of Micron, said it was unknown what worries Beijing had and those direct and indirect sales to businesses with headquarters in China were responsible for around a quarter of the chipmaker’s earnings.

“We are currently estimating a range of impact in the low single-digit percentage of our company’s total revenue at the low end, and high single-digit percentage of total company revenue at the high end,” Murphy said.

Source: malaymail.com

The comments allowed Micron’s stocks to recover some of their damages, the stock’s Nasdaq closing value was down 2.8 percent at US$66.23 (RM301.20).

Washington disagreed with Beijing’s action, however, it boosted the stock prices of Micron’s competitors in China along with South Korea, who are thought to profit as mainland enterprises look for memory chips from additional suppliers.

“We firmly oppose restrictions that have no basis in fact,” a spokesperson from the US Commerce Department said on Sunday.

“This action, along with recent raids and targeting of other American firms, is inconsistent with (China’s) assertions that it is opening its markets and committed to a transparent regulatory framework.”

Source: malaymail.com

Amid Chinese officials’ inspections and excursions to US management consultancy firm Bain and business surveillance group Mintz Group, hostilities between the US and China have risen recently.

Considering a succession of export restrictions by Washington on specific American products including chipmaking equipment to prevent them from being utilized to boost China’s defense potential, Beijing has now aimed at Micron as the primary US chip manufacturer.

Also Read: Will AI Take Over The World?

During an argument over semiconductor technology and deteriorating ties between Washington and Beijing, China started the assessment in late March.

The move also comes shortly after the Group of Seven nations agreed to “de-risk, not decouple” economic engagement with China and as US President Joe Biden called for an “open hotline” between Washington and Beijing.

The U.S. Business Department declared that it would communicate with Beijing officials officially to get more information about their conduct.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

In order to “protect Montanans” from alleged Chinese spying, Governor Greg Gianforte of Montana signed legislation on Wednesday banning Chinese-owned TikTok from functioning in the state. This makes Montana the first U.S. state to outlaw the well-known short video app.

TikTok poses a national security danger, according to FBI Director Chris Wray, who also noted that Chinese businesses are essentially forced to “do whatever the Chinese government wants them to in terms of sharing information or serving as a tool of the Chinese government.”

Congressmen expressed dissatisfaction in March about the Chinese government’s “golden share” in ByteDance, which gives it control over TikTok.

Also Read: Google to delete inactive accounts starting December

A Chinese government-affiliated business owns 1% of the ByteDance subsidiary Douyin Information Service, according to TikTok, which also claims that the ownership “has no bearing on ByteDance’s global operations outside of China, including TikTok.”

TikTok operations in the United States are a national security threat, according to FBI agent Wray, since the Chinese government may use video-sharing software to influence users or take control of their devices.

Among the dangers, according to Wray, is “the potential for the Chinese government to use [TikTok] to control data collection on millions of users or control the recommendation algorithm, which could be used for influence operations.”

Paul Nakasone, director of the National Security Agency, expressed concern in March about the information TikTok gathers, the mechanism it uses to distribute it to users, and “the control of who has the algorithm.” He claimed the TikTok platform may facilitate extensive influence operations since it could “turn off the message” and actively influence users.

According to TikTok, it “does not permit any government to influence or change its recommendation model.”

A 2017 National Intelligence law, according to lawmakers, gives the Chinese government the power to compel ByteDance to divulge user information from TikTok.

According to TikTok, because it was founded in California and Delaware, it is governed by American laws and regulations. According to TikTok’s CEO, the company has never shared and will never share user information with the Chinese government.

Also Read: Apple to open the first online shop in Vietnam

Eight states, including California and Massachusetts, initiated an investigation into TikTok’s potential participation in the harm to young people’s physical and mental health in March 2022. The focus of the inquiry is on how TikTok increases young users’ engagement, including how it purportedly lengthens their time on the network and how frequently they use it.

In August 2020, former President Donald Trump issued executive orders seeking to ban TikTok in the United States unless it was sold to an American company. The main reason cited for the proposed ban was the potential threat to national security posed by the app’s data practices. However, various legal challenges and negotiations delayed the implementation of the ban

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.