Binance and its CEO seek dismissal of CFTC complaint

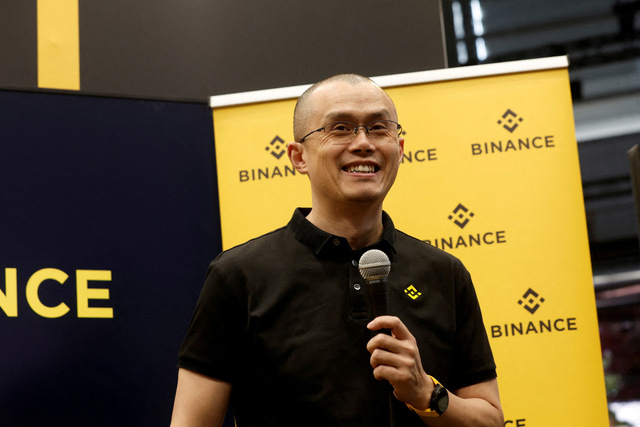

Binance and its CEO Changpeng Zhao have taken a decisive step in response to the complaint filed against them by the U.S. Commodity Futures Trading Commission (CFTC). According to a court filing made on Thursday, the world’s largest cryptocurrency exchange and its CEO are seeking to have the CFTC’s complaint dismissed.

The CFTC had initiated legal action against Binance, Zhao, and former Chief Compliance Officer Samuel Lim in March, alleging that they had violated the Commodity Exchange Act and certain federal regulations. The regulatory body accused the exchange of operating an “illegal” exchange and having a “sham” compliance program.

One of the main arguments presented by Binance for the dismissal of the case is that the CFTC is attempting to regulate foreign individuals and corporations that are based and operate outside the United States. They cited a 2007 ruling that stated U.S. law governs domestically but does not have authority worldwide.

It is worth noting that the holding company of Binance is located in the Cayman Islands, and its CEO, Changpeng Zhao, is a Canadian citizen. The CFTC, however, claimed that Binance had been involved in offering and executing commodity derivatives transactions on behalf of U.S. persons since at least July 2019, which would be in violation of U.S. laws.

Also Read: Japan’s Advantest sees AI driving demand for chip testing

In response, Binance asserted that starting from June 2019, it had implemented measures to restrict and off-board potential U.S. users and ensured that new users were not U.S. persons. The company also emphasized that the alleged digital asset derivative products were not offered until July 2019 and later, which was after the implementation of these restrictions.

Meanwhile, Samuel Lim, the former Chief Compliance Officer, has filed a separate motion to dismiss the CFTC claims against him, further complicating the legal proceedings. As of now, the CFTC has not provided any public comments on the recent motion filed by Binance and Zhao. The regulatory body is responsible for overseeing commodities and derivatives markets, including cryptocurrencies like Bitcoin.

It’s important to highlight that this is not the only legal challenge Binance and its CEO are facing. In June, they were also sued by the U.S. Securities and Exchange Commission (SEC), which accused them of operating a “web of deception.” The SEC listed 13 charges against Binance, Zhao, and the operator of its purportedly independent U.S. exchange.

As the legal battle unfolds, the cryptocurrency industry will be closely watching the outcome of these cases, as they may have significant implications for the regulatory landscape surrounding digital assets in the United States and beyond.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.