Australia hits buy-now-pay-later sector with consumer credit law

Australia said that it would govern buy-now-pay-later assistance as customer credit under the new legislation, requiring providers of BNPL to conduct history checks before providing what it said is expected to be one of the strictest regulations worldwide for the emerging sector.

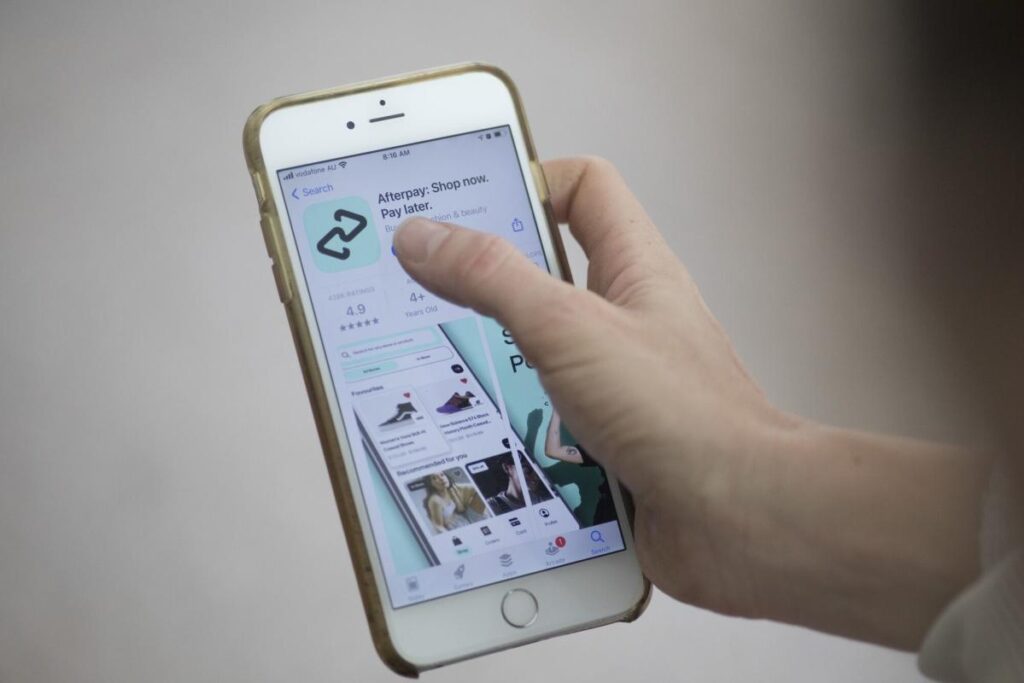

With this change, Block by Jack Dorsey Inc (SQ.N)-owned Afterpay as well as Zip Co would fall under the jurisdiction of the Australian Securities and Investments Commission (ASIC), putting Australia second only to the United Kingdom among nations that have attempted to monitor buy-now-pay-later as a normal credit product.

Cash-strapped consumers who take on debt, often more than they can handle, frequently employ BNPL firms, which usually provide on-the-spot free-of-interest loans for short periods with minimum verification of credit which disperse payments throughout weeks or months.

Also Read: OpenAI to introduce ChatGPT app for iOS

Since BNPL service providers refrain from charging interest, they are now immune from customer credit regulations. As a result, their company has soared during the e-commerce craze sparked by COVID-19 stimulus funds and extremely low-interest rates.

However, as Australia faces rising prices, which are currently at close to 30-year peaks, worries about repaying have grown. According to Australia’s center-left Labour administration, BNPL needs to be deemed credit as it exerts the same effect on debtors.

“BNPL looks like credit, it acts like credit, it carries the risks of credit,” Financial Services Minister Stephen Jones said in a speech in Sydney on Monday.

“Our plan prevents lending to those who cannot afford it, without stopping safe, prudent BNPL use.”

Source: reuters.com

Australia, which has approximately a dozen registered BNPL service providers, had roughly seven million operational BNPL user accounts throughout 2021–22, generating A$16 billion which is $11 billion in dealings, an increase of 37 percent.

Shopping industry data reveals that Australians made A$63.8 billion in transactions via the Internet in 2022, with 26 percent of Australians claiming to have paid using buy-now-pay-later.

The majority of the money made by BNPL companies comes from costing merchants a share of their earnings in return for sending customers to them. They impose late fees on borrowers but claim that by promising increased credit limits, they promote timely returns.

Although BNPL companies claim to carefully track the debtor’s behavior, a recently enacted Australian law would oblige these individuals to adhere to “responsible lending” constraints, which involve carrying out credit checks before lending, informing clients when their credit limits are increased, and adhering to legally mandated settlement procedures.

Also Read: Meta announces AI training and inference chip project

Later in the year, government officials will make the draught law available for comment, and by the finish of the year, the measure will have been submitted to parliament.

“The buy now, pay later business model is still a structural growth model,” said Shaun Ler, a Morningstar analyst.

“You end up in a situation where everyone is suffering but your competitors are suffering even more and the demand is still there,” Ler added.

Source: reuters.com

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person