EU antitrust regulators seeking more info on Apple Pay

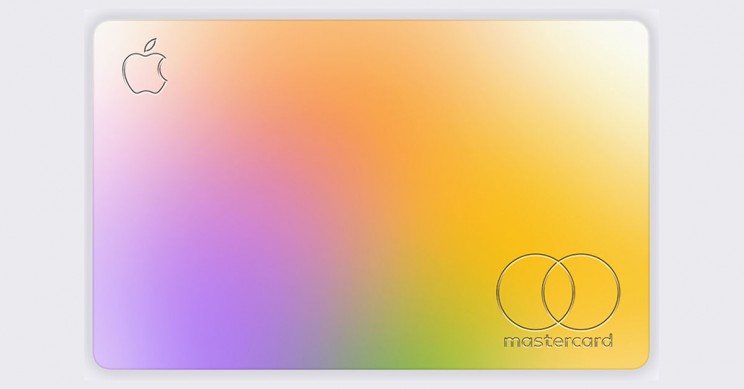

The European Commission announced on Wednesday that EU antitrust investigators are searching for additional details on Apple’s smartphone payment system, Apple Pay. This is an indication that the regulator is trying to plug any gaps in its allegations against the iPhone manufacturer.

A year ago, the EU antitrust authority alleged Apple conspired to make it hard for its competitors to establish competing solutions for Apple devices by limiting their access to its tap-and-go Near-Field Communication (NFC) technology, which is utilized for mobile wallets.

Also Read: Apple launches ‘buy now, pay later’ service in the US

“We can confirm the sending of requests for information,” a commission spokesperson said while declining to provide details.

Apple opted not to respond.

Apple has already mentioned the popularity of PayPal within its iOS smartphone OS as an alternative for users, along with rival MobilePay from Denmark, Swish from Sweden, as well as Payconiq from Belgium.

complainant Vipps and a mobile payment app from Norway claimed that NFC options are inefficient and uncompetitive.

It is rare for the commission to ask competitors and retailers for material now, three months afterward, Apple justified itself in an inquiry on February 14.

Following such hearings, the regulator normally makes its decision. If proven guilty of breaking antitrust regulations, the agency has the power to penalize Apple a maximum of ten percent of the company’s worldwide revenue.

Apple also debuted the “buy now, pay later” (BNPL) scheme in the United States in March, posing an imminent danger to the fintech industry, which is currently dominated by companies like Affirm Holdings as well as the Swedish payment provider Klarna.

With its “buy now, pay later” support, Apple is attempting to enter the loan industry. As a result, the corporation has established guidelines regarding how it will accept transactions. If you’ve been a loyal client in the past, this is one important consideration.

The Apple Pay Later service, which was introduced a year ago but is still under testing, will assess consumers based on their purchasing patterns in addition to which Apple products they now own.

Also Read: What is Apple’s rapid security response?

The service, which enables users to make purchases and spread-out payments over time, will also check to see if users have applied for an Apple Card credit card or any additional cards, they have associated with their Apple Pay account.

According to the firm, Apple Pay Later will enable customers to split expenditures into four installments spaced out over six weeks without any interest or fees. It will first be made available to a small number of users to bring it out to everyone in the upcoming months.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person