Alibaba CEO Elevates AI to Key Priority in Group Revamp Plan

Alibaba Group Holding Ltd, one of China’s tech giants, is embarking on a strategic transformation that places artificial intelligence (AI) and user experience at the forefront of its priorities.

This bold move comes as the company faces intensified competition and economic challenges in a rapidly evolving market. The newly appointed CEO, Eddie Wu, articulated his vision for the company in a memo to employees, marking a significant shift in Alibaba’s approach. Wu emphasized the need to pivot towards an “AI-first” strategy while remaining mindful of the hundreds of millions of users who contributed to the company’s immense success.

“We will recalibrate our operations around these two core strategies and reshape our business priorities,” Wu stated in his memo. This renewed focus on AI is in response to mounting competition from emerging rivals like ByteDance Ltd in the realm of social media and significant AI investments made by companies like Baidu Inc. Alibaba aims to reinforce its investments in AI-driven tech businesses, internet platforms, and its global commerce network, aligning with the broader trend of Chinese tech companies prioritizing AI.

Alibaba’s strategic shift is taking place against a backdrop of fierce competition and domestic economic challenges. The company is slowly recovering from a two-year-long tech crackdown imposed by Beijing, and the unexpected departure of former CEO Daniel Zhang, who had recently accepted the role of steering the key Cloud Intelligence Group, signals a changing landscape within the organization.

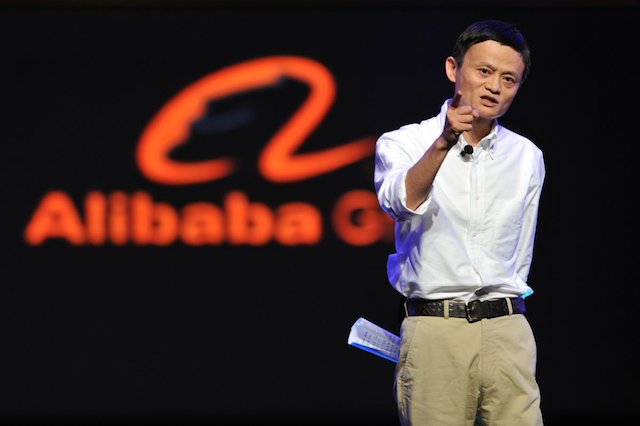

Analysts suggest that the departure of Zhang may lead to greater influence for the new leadership team, composed of Eddie Wu and group chairman Joe Tsai. Wu and Tsai, both long-time associates of co-founder Jack Ma, are taking the reins at a pivotal moment. Alibaba must not only defend its top position against competitors like JD.com Inc. but also navigate a complex plan to split into six major business units.

Among these divisions, the cloud unit is seen as a significant potential growth driver, particularly in the AI infrastructure and services sector. Alibaba is actively seeking fresh funds, with plans for a Hong Kong initial public offering of its Freshippo grocery chain temporarily on hold due to valuation concerns.

Also Read: G-20 Broadens Debate on AI Risks and Mulls Global Oversight

Alibaba’s entry into the global AI race aligns with the broader importance of AI in tech companies and national strategic objectives. While the company did not secure initial regulatory approvals for offering generative AI services in China, it has made notable strides with the integration of AI models like ChatGPT into its meeting and messaging apps.

Jeffrey Towson, a partner at TechMoat Consulting, emphasized the significance of the cloud division, stating, “Who is going to run Alibaba Cloud is now the single most important growth question for Alibaba.” The company remains committed to independently spinning off the cloud unit, which seeks to raise substantial funding, potentially involving Chinese state enterprises.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.