The US Citizens Can Now Finally Use the Apple Card

Apple finally launched its most anticipated Apple card on Tuesday. For now, it will only be available for the users in the U.S. The users can apply for the card directly from their Apple Wallet app on their iPhone. They do not have to wait for the physical card to arrive as they can use it virtually through the Apple Pay as soon they request for the card.

The new card is the digital-first card that the iPhone users will get, and it will even make the credits private for the users. According to Apple, no system will keep the record of from where and when a user has shopped and what amount did he pay, like, in the cash system, it will keep the credits anonymous. So the users don’t have to worry about their data being sold by the company. But the users can see their spendings and balance in the card through the Apple Card app. They can also keep the record of the cash backs they got and see where they spent their money in Apple Maps.

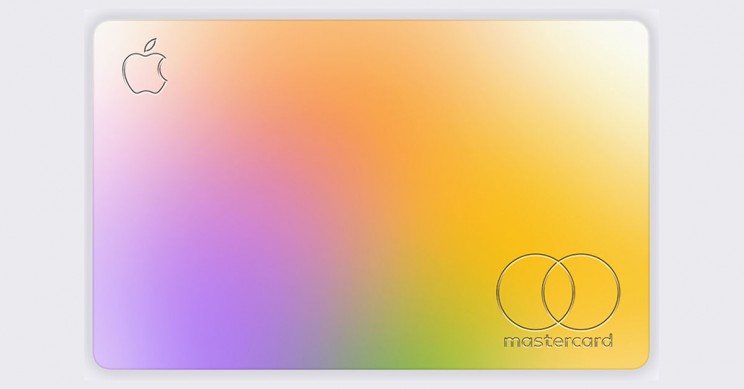

Apple has partnered with Goldman Sachs and Mastercard to design and process the card. There is no annual fee, cash advances fees, over the limit fees or late fees, that the user needs to pay to use the card. And moreover, according to the claims made by the company, it has got even lesser interest on the purchases. In fact, the company will be providing incentives and cash rewards to users for using the new card. The card is acceptable at every merchant accepting Mastercard.

The new card also renders some interesting features, like it changes colour for different types of spendings. For example, if a user is using the card for a restaurant bill, the card will turn orange. And if the spending is on entertainment, the card colour will be a mix of orange and pink. Apple has already started 3% cashback on purchase through the virtual card at selected merchants, including Uber and Uber Eats. With the physical card, the cashback will be 1%.

The new app to use the card is available for the users, who own an Apple 6 or a newer model running iOS 12.4. To use the app, you need to go to the Apple Wallet and tap on the (+) icon on the upper right corner on the screen. Then, a Continue button will appear along with a small description of the Apple Card. Upon tapping on the Continue button, a list of Card Type will appear, where you need to select Apple Card. Then you must verify and confirm your details by filling in the information and accept the Apple Card terms and conditions on the next screen.

After that, Apple will send you a description of the credit limit and interest rates based on your information, where you need to tap on Accept Apple Card. This way, the card will be ready for use.

Yashica is a Software Engineer turned Content Writer, who loves to write on social causes and expertise in writing technical stuff. She loves to watch movies and explore new places. She believes that you need to live once before you die. So experimenting with her life and career choices, she is trying to live her life to the fullest.