UAE-founded and Saudi Arabia-headquartered fintech Tabby has recently clinched a monumental $700 million debt financing round from J.P. Morgan, propelling its plans for an initial public offering (IPO) in the kingdom.

Empowering Fintech Growth in the MENA Region

Tabby, a burgeoning financial services app in the MENA region, has struck a significant deal with J.P. Morgan, setting a regional milestone as the largest asset-backed facility obtained by a fintech company in this territory.

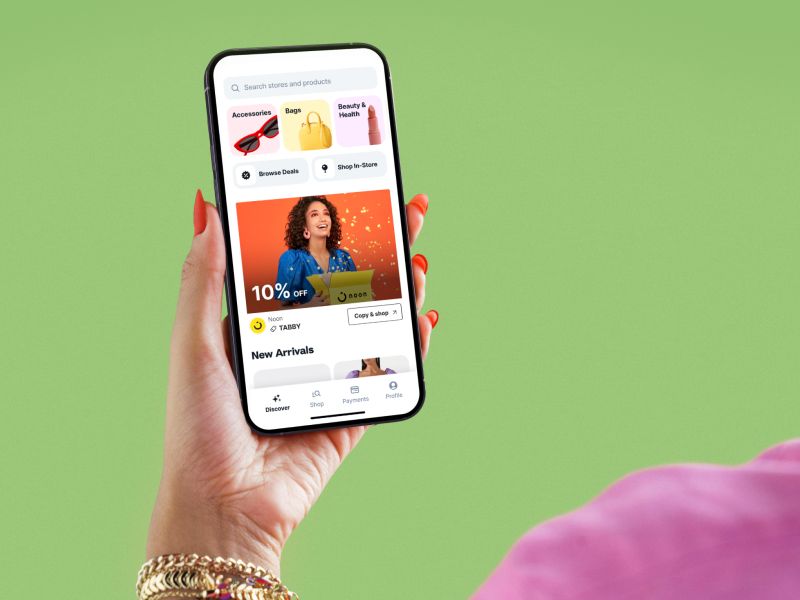

Image Source: tabby

This financing coup arrives hot on the heels of Tabby’s previous successful funding rounds, where it raised $200 million in Series D equity financing and subsequently upsized its debt facility to $350 million. With these strategic moves, Tabby is on an accelerated trajectory, positioning itself robustly in the competitive fintech landscape.

Founded in 2019 by Hosam Arab, Tabby has rapidly evolved, offering users a seamless buy now, pay later (BNPL) facility for both online and offline shopping experiences. Managing an impressive $6 billion in annualized transaction volume, Tabby’s influence in reshaping personal finance in the region is becoming increasingly evident.

The latest financial boost not only fortifies Tabby’s financial foundation but also amplifies its capability to expand its suite of financial services and shopping products. With a consumer base of 10 million and partnerships with over 30,000 retailers, Tabby aims to deepen its impact and redefine financial access and convenience across the MENA market.

Visionary Leadership and Strategic Collaboration

CEO and Co-Founder Hosam Arab expressed immense pride in achieving this milestone, emphasizing the significance of the collaboration with key investors like J.P. Morgan, Hassana Investment Company, Soros Capital Management, and Saudi Venture Capital. This collective backing underscores Tabby’s pivotal role in revolutionizing personal finance and shopping experiences in the MENA region.

George Deves, Co-Head of Northern European ABS at J.P. Morgan, highlighted the importance of fostering a vibrant consumer lending sector, affirming their commitment to support retail credit in the Middle East through this strategic partnership with Tabby.

Ahmed Al Qahtani, Chief Investment Officer for Regional Markets at Hassana Investment Company, echoed the sentiment, emphasizing their belief in Tabby’s vision and its potential to reshape the future of financial services across Saudi Arabia and the broader MENA region.

Tabby’s achievement further solidifies the MENA region’s growing prominence in the global fintech arena. With recent funding rounds and strategic partnerships becoming the norm, the landscape appears ripe for continued innovation and disruptive growth in the realm of financial technology.

As Tabby sets its sights on an IPO in the kingdom, its journey reflects not just its own success story but also the evolving narrative of fintech in the region, poised for transformational change.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.