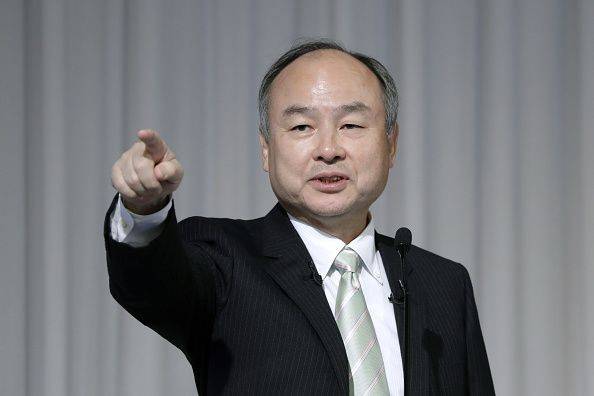

Masayoshi Son is a Korean-Japanese technology billionaire, financier, and investor. Masayoshi is the founder, chairman, and CEO of the Japanese holding corporation SoftBank, the Chairman of Arm Holdings, and the CEO of SoftBank Mobile.

Son has the recognition of having suffered the worst financial loss in history (about $70 billion during the dot-com crash of 2000), but as of September 2022, he is ranked 73rd on Forbes’ ranking of The World’s Billionaires 2022.

Early Life

Masayoshi Son was born into a second-generation Zainichi Korean family in Japan.

He was intelligent and inquisitive from an early age and was intrigued by America. He visited the US at the age of 16 years old for a short study abroad program. He subsequently decided to stop going to school in Japan and spend more time in the US. He made the decision to enroll at Holy Names University after high school.

He switched to the University of California after two years and studied computer science and economics there. During this time, he realized that microchips could help him become extremely wealthy and that computer technology will soon alter the business world. He decided to come up with a minimum of one business concept each day to maintain this spirit.

He had over 250 ideas toward the year-end, some of which would later result in enormous riches. In the year 1980, he earned a BA in economics.

Success Story

After earning his degree in 1980, he founded Unison in Oakland, California, which Kyocera eventually acquired. Despite his triumphs, Son left the USA. He established Softbank in Japan in 1981 with two part-time employees and a modest office. During that time, Softbank distributed software packages to Japanese customers.

Within one year, Softbank had already begun to diversify. In 1982, the company launched two monthly magazines concerning software and PCs. By the late 1980s, Softbank had developed an incredibly well-liked system that allowed customers all throughout Japan to select phone operators that offered the most affordable rates for local and long-distance calls.

But it was Softbank’s investment in Yahoo that gave it public attention. Yahoo’s largest shareholder, Softbank, established Yahoo Japan as its Japanese affiliate.

Between 1995-1998, Son staked $374 million on Yahoo, and at its height, his investment had generated a 50-fold profit. Son had made investments in several tech firms by the late 1990s, like Kozmo.com, SportsBrain, and More.com.

The dot-com crash

Son was particularly hard-hit by the dot-com crash in 2000. 99% of the value of Softbank’s shares was lost, according to experts, making it the largest single-person wealth loss in history. Although it was a devastating blow, Son was unflappable. He made an effort to restore his empire by starting a new company that offered broadband services in Japan.

Before being able to acquire Vodafone Japan in 2006 for almost $15 billion, SoftBank tried for years to break into the burgeoning mobile industry. At the time of its takeover, Vodafone Japan was right on the edge of bankruptcy, but Son nevertheless managed to position himself as a strong player in the Japanese phone industry.

Today, his company SoftBank Mobile is the most successful telecom company in Japan. In 2013, he acquired Sprint Nextel, an American telecoms holding company, for $22 billion in 2013. Sprint is currently the fourth-largest provider of wireless networks in the USA.

He also took another action during the 2000 dot-com crash that shaped his career for the following ten years. He invested over $30 million in Alibaba, a relatively unknown Chinese company at that time.

Alibaba has since grown to be among the most valuable businesses worldwide, and Softbank’s ownership has now reached an astounding $130 billion, representing a 2240x profit on his initial investment.

With the profits from Alibaba in hand, Softbank is now stepping up its attempts to invest in companies all around the world. It has started a $100 billion Vision Fund to guide the direction of global technological advancement.

Masayoshi Son is one of the most active investors and, through his company SoftBank, has the largest investments in firms like Yahoo! and Alibaba.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.