Apple is taking a major step toward providing its customers with more banking services. The company announced today, that it is collaborating with Goldman Sachs to launch a new high-yield savings account feature for Apple Card credit cardholders that will allow them to save and grow their Daily Cash which is the cashback rewards earned from Apple Card purchases.

In the upcoming months, Apple says cardholders will be able to automatically save this money in a new, high-yield savings account from Goldman Sachs which will be accessible through Apple Wallet. Customers can also deposit their own funds into this account.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet,” Bailey said in a statement late on Thursday.

Source: in.investing.com

According to Apple, the account has no fees, minimum deposit, or minimum balance requirements, making it competitive with various neobanks that are often used as a way for customers to reserve digital cash and monetize interest payments.

However, Apple did not specify what interest rate would be paid out on these high-yield accounts in its press release. According to Bankrate data, competitors are currently offering APYs ranging from 2.20% to 3.05%. According to Investopedia data, some are going even higher, with APYs currently exceeding 3.1%. Apple stated that it is not prepared to announce the APY due to the current highly volatile interest rate environment.

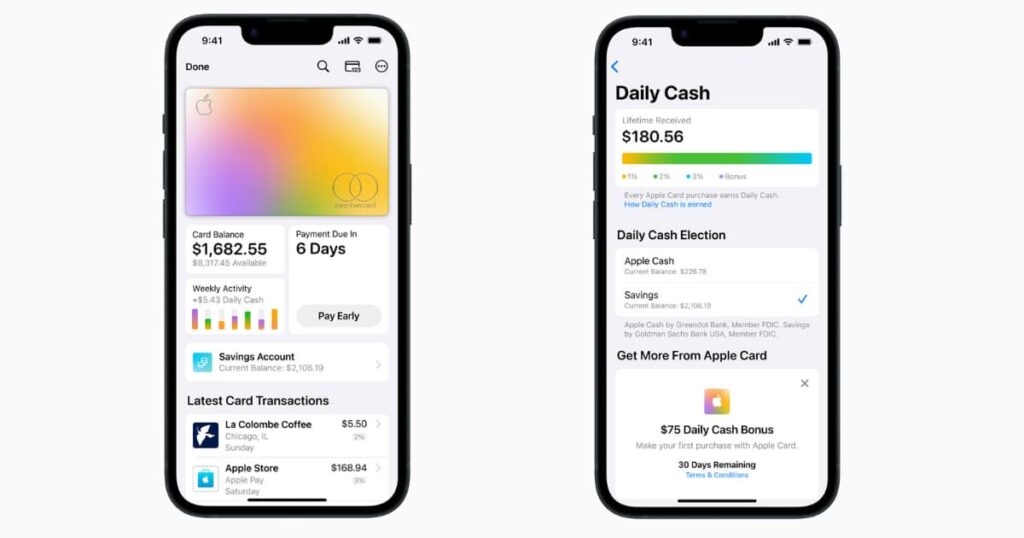

When the new service becomes available, Apple Card users will be able to set up and manage their Savings account directly in the Apple Wallet mobile app. From then on, all Daily Cash earned through Apple Card purchases will be automatically deposited into this account, unless customers choose to have the cash added to their Apple Cash card in Wallet instead, as they do at the present time. According to Apple, this option can be changed at any time.

An in-app Savings dashboard will show the account balance as well as the interest earned over time.

Apple currently offers 3% cashback on Apple Card purchases made with Apple Pay at select merchants such as Apple, Uber/Uber Eats, T-Mobile, Walgreens, Panera Bread, Nike, ExxonMobil, and Ace Hardware. Apple Card purchases will earn 2% cashback when using Apple Pay, and 1% cashback when using the titanium card or a virtual card number to shop online.

Cardholders would not have to depend solely on Apple Card purchases to fund their brand-new Savings accounts. Customers will be able to deposit additional funds via a linked bank account or their Apple Cash balance, as per Apple’s statements.

They can also withdraw this money at any time by transferring it to the same linked bank account or any linked bank account or even their Apple Cash card, without incurring any fees.

Apple has been steadily moving into the payments market with the launch of the Apple Card, allowing it to establish a more direct connection with its customers as it accelerates its “services” business, which perceives it selling subscriptions to a variety of offerings, including Apple Music, Apple Arcade, Apple TV+, iCloud+, Apple Fitness+, Apple News+, and more.

It’s also attempting to make Apple Pay a more realistic choice for online shopping, with the announcement of an Affirm competitor, Apple Pay Later, for dividing purchases into four interest-free payments. This offering, however, has been postponed until 2023, according to Bloomberg.

Meanwhile, Goldman Sachs has been repositioning itself as a more traditional bank with its Marcus by Goldman Sachs product, which announced last year that it had reached a milestone of more than $100 billion in customer deposits after five years of operation. The collaboration with Apple will give it a new perspective on the consumer deposits market.

Apple did not provide a specific launch date for its high-yield Savings account, only stating that it would be available in the coming months. The company stated that the Savings account feature will be included in an upcoming iOS release, but did not specify which version number would include the option.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person